V3 Research

Chainlink (LINK) 预言机龙头:这枚代币值得投资吗?

BitcoinEthereumNews

Article reports a whale swapping 4,806 ETH for LINK, contributing to a surge toward a 2025 peak price and highlighting volatility-driven opportunities.

InvestingHaven

Long-term forecast expects LINK to trade between $17 and $44 in 2025, offering a wide range that reflects both upside potential and uncertainty.

Twitter

推文指出 2025 年 TVS 暴增 90% 至 930 亿美元,Chainlink 在 DeFi 市场份额达 68%,并强调其飞轮效应和投资机会。

Twitter

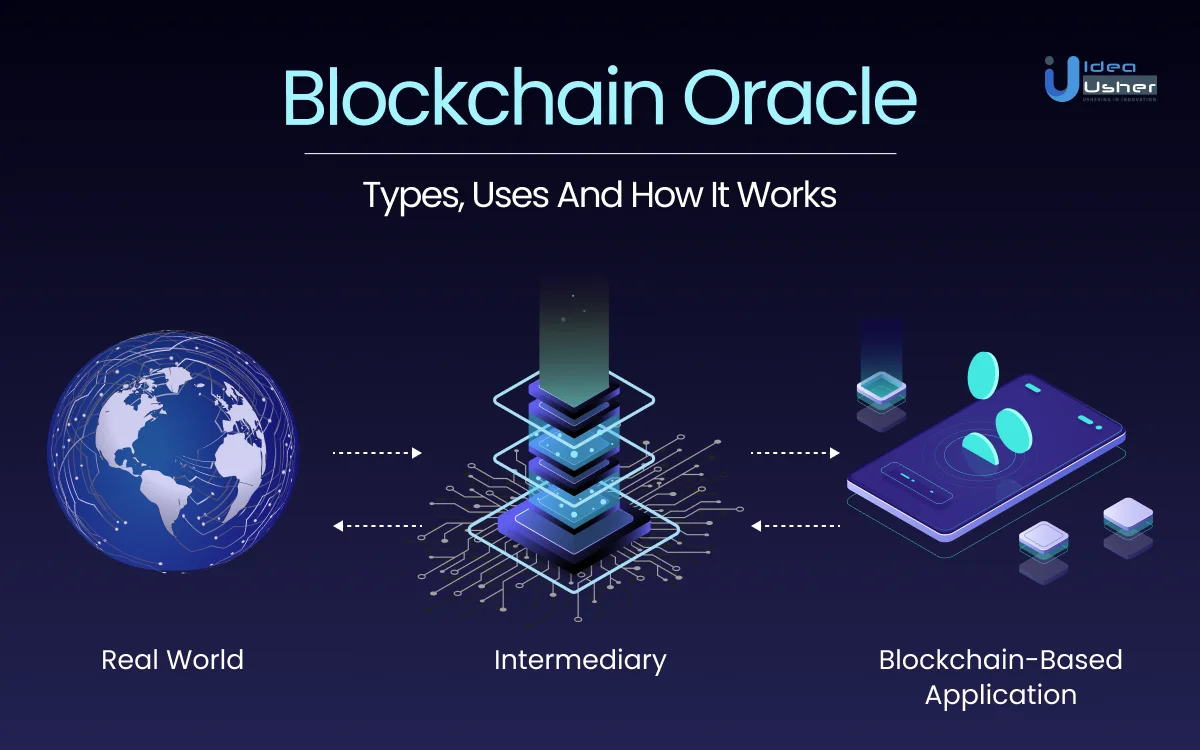

推文将 LINK 比作 2020 年的 NVDA,强调公链需要预言机数据、水电等基础设施,Chainlink 提供关键链下数据。

关键发现

投资逻辑与基本面

风险-收益评估

市场定位与催化剂

实施建议

-

退出策略:需关注 2021 年创下高点 52 美元的水平及后续代币经济调研情况,若网络收入未能持续提升,应及时评估减仓策略。

结论

对于看好区块链基础设施及 RWA 长期成长的投资者来说,并且能够接受加密资产的高波动性,LINK 提供了一种颇具吸引力的风险-收益替代选择;但建议采用分散投资和质押策略,并密切关注网络费用、机构合作以及宏观流动性变化的动向。

(Visit Discover for more)

185 days ago