V3 Research

Megaeth or Monad - Which project would be more suitable for participating in token sale events?

Twitter

Tweet thread outlines strategies to qualify for a potential Monad airdrop, emphasizing diverse on-chain activity and IP distribution to avoid Sybil detection.

Yahoo Finance

Report on MegaETH canceling a buyer’s $1 million MEGA token allocation after public hedging remarks, sparking debate on project fairness.

The Defiant

Article describes divergent community views on MegaETH’s oversubscribed ICO and selective wallet whitelisting process.

DL News

DL News details how MegaETH rescinded a $1 million allotment because the participant discussed hedging, highlighting strict sale rules.

Conclusion

Monad’s upcoming public sale via Coinbase offers broader retail access and fewer restrictive lock-ups than MegaETH, making it the more participant-friendly token sale option 13312.

| Metric | Monad | MegaETH |

|---|---|---|

| Sale venue | Coinbase public sale accessible in 80+ countries 13 | Project-hosted auction with discretionary KYC cuts 610 |

| Target raise | ≈ $188 M 14 | ≈ $450 M, 28× oversubscribed 921 |

| Lock-up | Optional; locked MON cannot be staked 35 | ≥ 1 year lock-up; no hedging or OTC allowed 2021 |

| Allocation claw-back risk | None disclosed | $1 M allotment revoked post-announcement 24 |

| Claimed TPS | 10,000 TPS, 0.8 s finality 24 | 100,000 TPS, sub-ms latency 37 |

Executive Summary

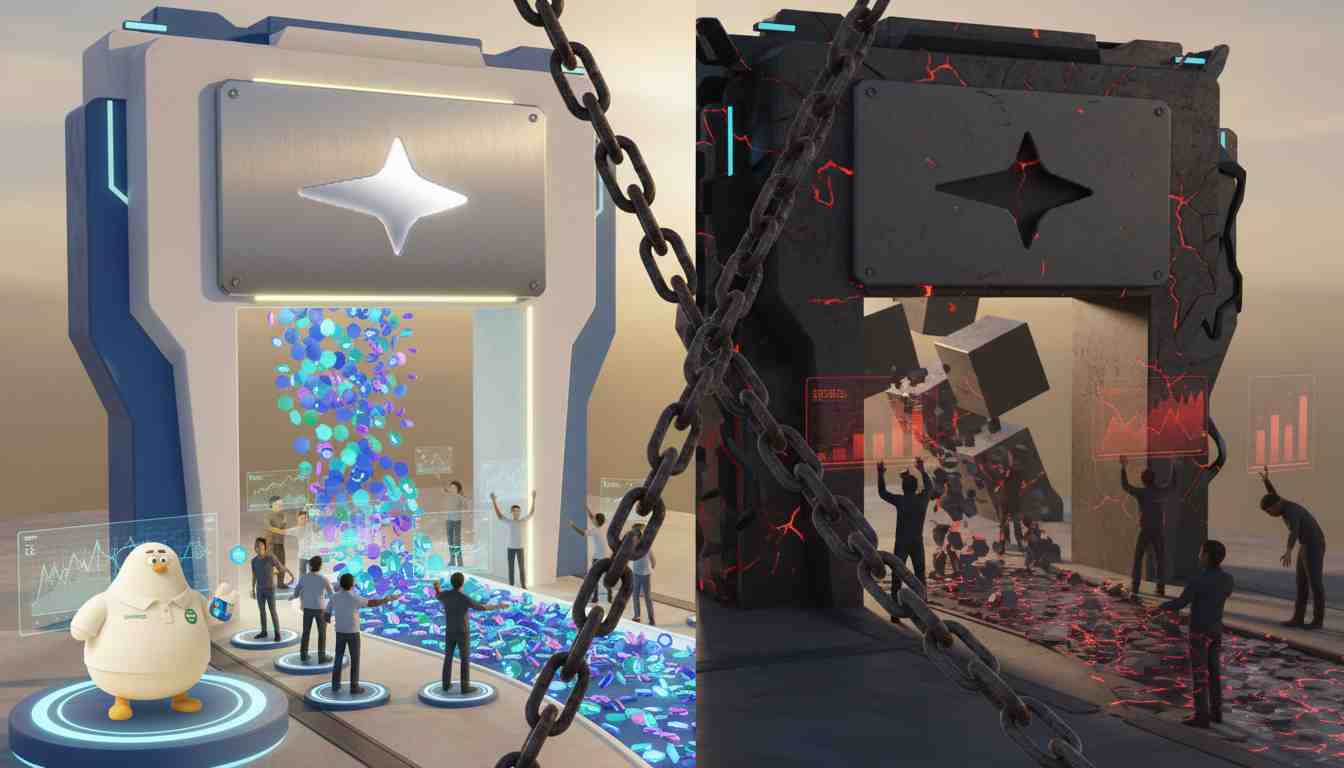

Monad and MegaETH both promise high-performance EVM environments, yet their token sale structures diverge sharply. Monad emphasizes accessibility through Coinbase with transparent documentation, while MegaETH’s self-hosted sale has drawn criticism for revocations and stringent lock-ups. For participants prioritizing certainty of allocation and early liquidity, Monad currently presents the lower-friction path.

Accessibility & Sale Mechanics

Monad’s partnership with Coinbase simplifies fiat ramps, enforces uniform pricing, and allows residents of over 80 jurisdictions to participate, broadening the pool of eligible buyers 1331. In contrast, MegaETH’s auction required whitelisting based on on-chain scores and social signals, accepting only ~10% of 49,976 wallets and later disqualifying even compliant buyers, illustrating discretionary risk 682.

Allocation Fairness & Community Reaction

Community sentiment toward MegaETH soured after the project rescinded a $1 M allocation when the buyer mentioned hedging, highlighting opaque enforcement of “long-term holder” ideals 2420. Multiple reports note split opinions about the fairness of MegaETH’s distribution filters and KYC rejections 310. By contrast, Monad’s disclosures outline sale percentages, market-making reserves, and explicit risks without evidence of retroactive penalties, earning comparatively positive anticipation 112314.

Tokenomics & Lock-Up Terms

MegaETH enforces a minimum one-year lock-up for many tokens and bars any hedging or transfer during that period, potentially limiting exit flexibility for retail participants 202125. Monad’s documentation clarifies that locked MON cannot be staked—removing yield opportunity—but does not universally impose lock-ups, allowing earlier liquidity access if buyers opt for the unlock tranche 3135. The 0.16% market-making buffer revealed in Monad’s 18-page sales file also seeks to stabilize initial trading, whereas MegaETH relies on strict behavioral covenants to curb volatility 1120.

Risk Profile & Secondary-Market Outlook

Both projects carry elevated FDVs; commentators warn that hype plus limited float could pressure post-TGE pricing 2932. However, MegaETH’s claw-back precedent and heavy lock-ups introduce additional idiosyncratic risk for buyers needing optionality 222. Monad faces concerns about parallel execution delivery and centralization of early liquidity, yet Coinbase listing may bolster initial exchange depth 1423. Overall, Monad’s clearer rules reduce non-market risk for sale participants.

Further Exploration

- Compare technical roadmaps to see which chain can ship promised TPS first.

- Analyze historical Coinbase sale performance as a proxy for MON’s listing dynamics.

- Model post-unlock supply cliffs for both tokens to gauge overhang risk.

- Track validator decentralization metrics after mainnet launch.

- Examine governance frameworks to assess long-term holder influence.

Which dimension—unlock schedules or exchange liquidity projections—would you like to explore next?

(Visit Discover for more)

99 days ago